Compounded interests. One of several methods to grow value.

The beauty of investments is that small amounts will compound over a long time into huge fortunes, as long as you don't interrupt the process.

The quote above is from a wealth-tech application. Several other apps also have some narrative similar to that too: save for a long period to enjoy compound interests.

I've found that to be false, or at least, not entirely true.

TLDR; save, but over short periods at a time then reinvest, that is how you get compounded returns.

A case study. An individual deposits some amount of money—this could be one-time or periodically—and earns a specified interest, say 10%, per annum. All well and good, except one could be very disappointed at the meager 'returns' at maturity, especially when savings were made periodically. This is no fault of the apps, it's just how interests work, simple interests.

Simple interest

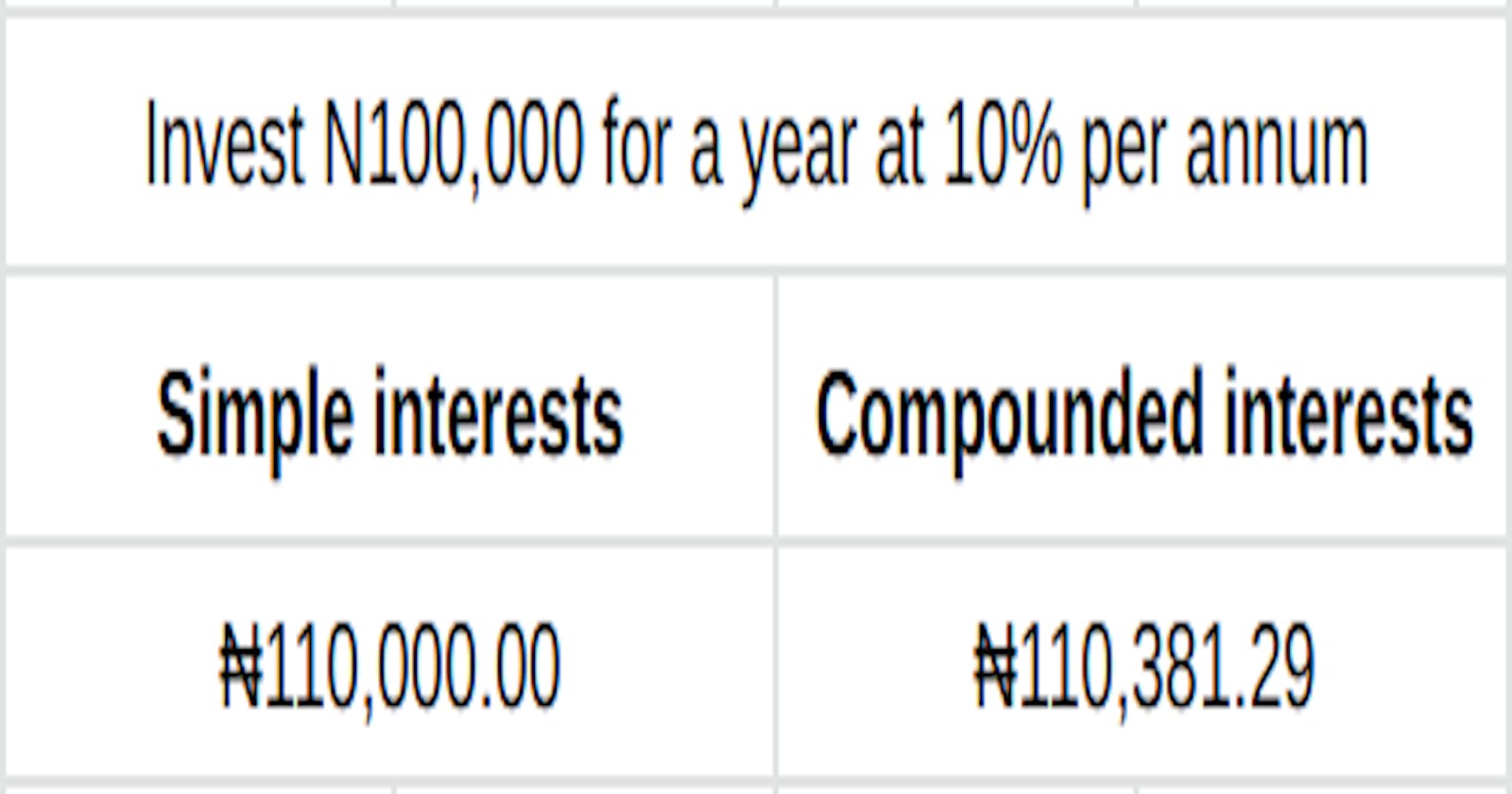

Very straightforward. If you invest a hundred thousand Naira (N100,000) at an interest of 10% per annum, at maturity, you would have a total of a hundred and ten thousand Naira (N110,000).

Usually, fintech apps would add interactivity by showing 'daily earnings'. That is just dividing your returns of ten thousand Naira (N10,000) by 365. In some cases, this also serves to show that you do not have to wait till a year is up before reaping benefits. If you make a withdrawal after three months, that is a quarter of the year, you would have earned approximately two thousand, five hundred Naira (N2,500).

Again, simple enough.

Periodical savings

The situation is different when you make periodic deposits.

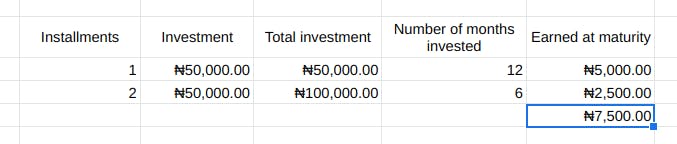

Say you want to save a hundred thousand Naira at 10% p.a. But you do it in two installments: an initial deposit of fifty thousand Naira (N50,000), and another fifty at the 6-month mark. You would not be making your perceived return of ten thousand Naira (N10,000). Why?

Because your initial deposit was the only batch that earned interest for a full year, netting you five thousand Naira (N5,000). Your 6-month batch earned half of that, making two thousand, five hundred Naira (N2,500).

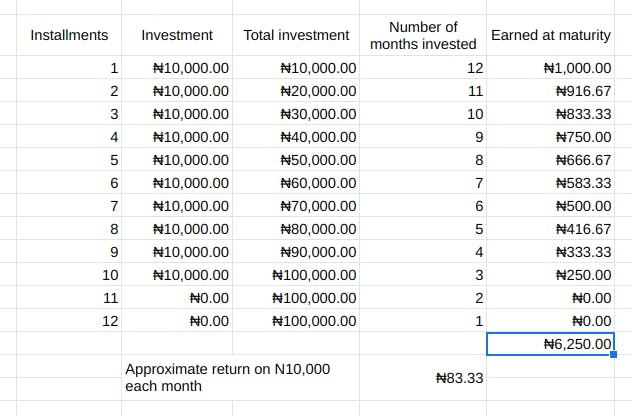

With that said, should your deposit frequency increase, say ten thousand Naira (N10,000) for 10 months, at maturity, your earned returns would be far lower than the expected ten thousand.

Compound interest

A simple way to put it is, interest earned on interest.

Using the example above, at your year's maturity with a total of a hundred and ten thousand Naira, you re-invest it's entirety for another year. This time earning eleven thousand Naira, netting a total of a hundred and twenty-one thousand Naira.

And there's the difference. If the said initial investment was only left for a two year maturity period, you would have earned a hundred and twenty thousand Naira alone.

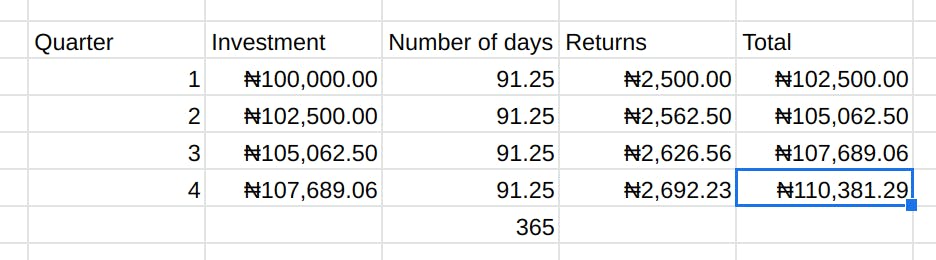

Now, here's the magic. Take the case of a hundred thousand Naira (N100,000) for a year at 10% per annum. You stand to gain far more if you apply the principle of compound interests like so: save in 3-month intervals.

You leave it in for three months, earn interests of two thousand, five hundred Naira (N2,500) and put that back in for another three months. At 6 months, you would have earned, in interests, two thousand, five hundred and sixty-two Naira, fifty kobo (N2,562.50). A difference of 62.50. Just because you took it out and put it back in. Apply that to the remainder of 6 months, and you net a total of one hundred and ten thousand, three hundred and eighty-one Naira, twenty-nine kobo (N110,381.29).

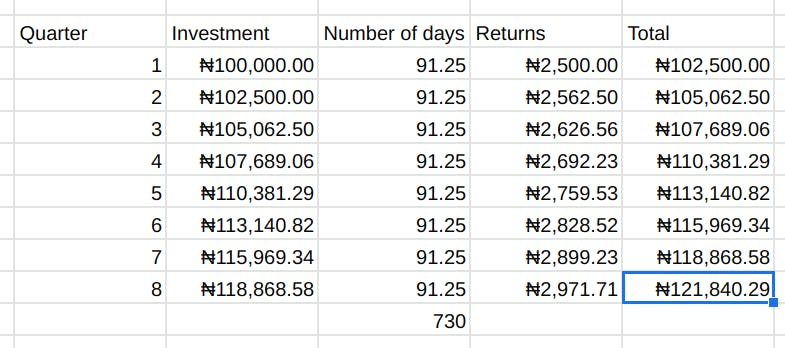

The splendor of compound interests. Repeat that a few more times and you get a hundred and twenty-one thousand, eight hundred and forty Naira, twenty-nine kobo (N121,840.29).

It's really not linear.

Good business

I said earlier that these apps were not being fraudulent, or deceptive. Not really. Some encourage you to "re-invest" to earn that compound interest. While some just ask you to leave it in there for a longer period.

Oh, the joy if apps could just build that in by default: lock-in for a year, compound at 3-month intervals. Keep the benefits of a "lock-in" feature and earn compound interests too.

Has that never occurred to them? It most likely has. I'd love to then understand their rationale for not building it.

Deji Joseph